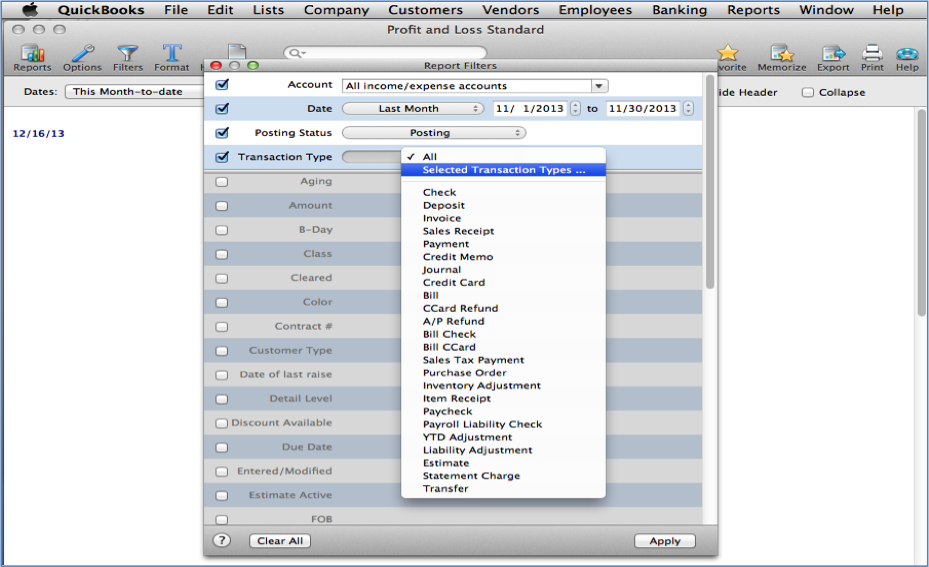

QuickBooks provides several reports to assist in troubleshooting beginning balances when the problem cannot be identified through the Client Data Review tool. If you prefer not to reverse the entry at 1/1, then choose Don’t Reverse.Īs each task is completed, the status can be changed from Not Started to In Progress or Completed within CDR.ĪDDITIONAL REPORTING TO HELP TROUBLESHOOT BEGINNING BALANCE CHANGES IN QUICKBOOKS Then choose Save & Close on the reversing entry. If there are certain accounts to remove or add to the reversing journal entry, these can be added once the journal entry appears. Once the Adjusting Journal Entry is saved, the following message appears:Ĭhoose View Suggested Reversing Entries if any part of the entry should be reverses on 1/1 of the following year. Therefore, a customer must be entered in the line of the journal entry similar to “CPA adj.” Once the adjustment is entered correctly, select Save & Close. Note that in this example, part of the adjustment is to Accounts Receivable. The Adjusting Entry box is checked with the journal entry date being the ending date of the prior period.

#Quickbooks for mac bank discrepancy trial

Once the differences have been reviewed and the adjustment proposed to adjust the prior ending balances to the prior trial balance, then select View Suggested Adjustments.Īfter selecting View Suggested Adjustments, the Make Journal Entries window opens.

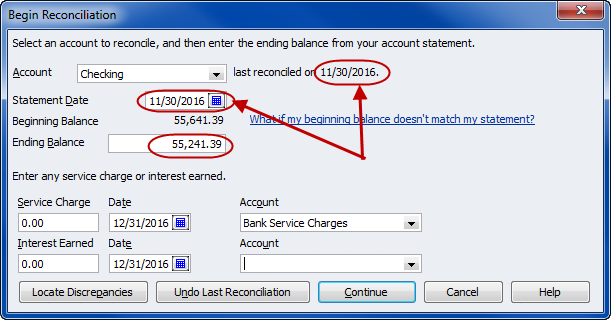

Alternatively, the View Changed Transactions at the top of the window can be used to generate a report of the transactions that contributed to the discrepancy. The transactions that contributed to the balance discrepancy can be reviewed by double clicking on the difference in blue and using QuickZoom to open into the discrepancy. After entering the Trial Balance from the previous period, the Difference column calculates the entry that needs to be made to adjust the account balances back to the last reviewed balance. When the Client Data Review is started in future periods, the prior information is populated in the Last Review Balances column as long as the review takes place in the client’s file. The first year the Client Data Review is used, will require the Ending Trial Balance from the prior period’s tax return or financial statement be entered. Symptom: Ending balances used by the tax accountant have changed from year to year. Ĭommon Error: Users record, modify, delete and void transactions in accounting periods for which tax returns have already been prepared and filed. The Troubleshoot Account Balances tool in the Client Data Review identifies these transactions quickly.

QuickBooks provides tools for not only preventing changes to prior periods, but also finding them easily.

When tax returns have been completed and filed, prior period adjustments must be handled carefully and cautiously. Often, clients make changes in their QuickBooks ® file to prior periods and are not aware of the affect these changes have.

0 kommentar(er)

0 kommentar(er)